Toronto’s vacancy tax has come up in conversation around the office lately. As a Toronto real estate agent, it’s our job to educate our clients on what is going on in the Toronto real estate market. My name is Britt Huggins, I am a realtor on the SO&Co. team and today I am here to talk about what Toronto’s vacant home tax is and why it was created.

What Is The Vacant Home Tax?

Most of us are aware that Toronto and the surrounding areas have experienced inventory issues when it comes to real estate. The City of Toronto has introduced the “Toronto Vacant Home Tax” in an effort to increase the housing supply by encouraging homeowners to keep their properties occupied and those who choose to purchase properties and leave them unoccupied will be subject to the Vacant Home Tax. This is an annual tax that will be charged on Toronto residences that are vacant status. This means they will lose their right to claim the property as their principal residence.

When Is a Home Considered Vacant

If the property is not used as the principal residence by the owner, has no permitted occupants, or is unoccupied for six months plus during the previous year, it is considered vacant. The deadline to declare a property’s 2022 occupancy status is February 2, 2023. To declare your property status online visit the online declaration form.

NOTE: If a property DOES NOT contain a residential unit (self-contained unit with a dedicated kitchen and washroom), a declaration is NOT required.

Property Status and Vacant Home Tax

If you are having a difficult time determining the status of your property and whether or not you are responsible for paying the Vacant Home Tax, take a look below at the table found on the Vacant Home Tax page on the Toronto.ca website.

Vacant Home Tax Exemptions

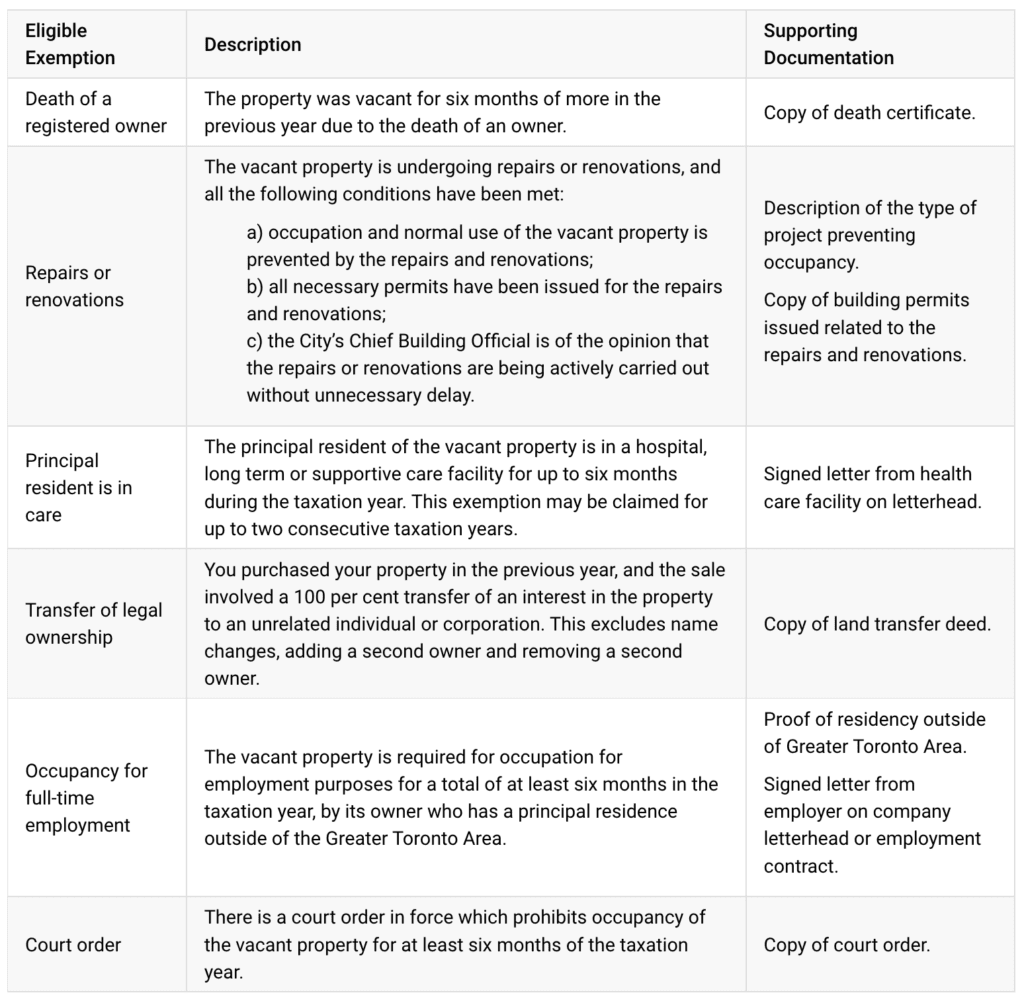

There are some instances when a vacant property may be exempt from the Vacant Home Tax. For example, the owner of the property dies, a home undergoing renovations, etc. See the table below, pulled from the Toronto.ca website that lists out cases that are considered exempt from the tax.

Mandatory Declaration of Occupancy Status

Moving forward, all Toronto homeowners will be responsible for annually declaring the status of their Toronto real estate, regardless if they live there or not. This declaration will dictate if the Vacant Home Tax applies or not.

NOTE: principal residences are legally allowed to be left vacant for a period of six months throughout the tax year without having to pay the tax. The six-month period can be spread throughout the year.

How is the Vacant Home Tax Calculated

The Vacant Home Tax is new to us all, even as a Toronto Real Estate Agent, I’m learning about this new tax. The calculations are based on 1% of the CVA (current value assessment). This will be inflicted on all Toronto homeowners that are declaring their property as vacant for more than 6 months in the previous year. The Vacant Home Tax will be based on the assessed value of your home through MPAC, not the market value. For example, if the CVA of your home is $800,000, you would owe $8,000 (1% x $800,000).

How Was The Vacant Home Tax Created?

After a year or two of studies on how Toronto could improve its housing market, the vacant home tax came about. The report that led to the creation of this tax was presented at a meeting on May 27, 2015. The information was compiled by the City’s Affordable Housing Office and contained multiple recommendations for preventing future spikes in housing prices and improving affordability in the city. The report was discussed at a meeting of the Toronto Affordable Housing Committee on May 10, 2015, where it was discussed and a recommendation presented to Council for consideration on June 2, 2015.

From there, several people had an opportunity to provide input. The committee met again on June 16, 2015, and a motion was put forward by Councillor Josh Matlow that “the City of Toronto should explore all possible revenue sources to address its affordable housing affordability gaps.” The motion passed by an 11 – 4 margin.

The Mayor and his Executive Leadership Team then presented their report to the City Council on June 29, 2015. That report, which included several recommendations, was approved by Council on July 2, 2015. On July 25, 2015, Mayor John Tory and Council introduced an amendment to the Annual Budget for 2016 that provided for amendments to the TMC. One part of that amendment made the vacant home tax applicable to all property owners, not just owners of newly constructed homes. It is why you will find advertisements from lawyers recommending that if you want your property exempted from this tax, you must build on it within one year of completing construction.

This tax has received a lot of criticism for being so unpopular with Torontonians. Still, it was presented as an effective tool for raising revenue to combat the issues that impact the affordability of housing in Toronto. We’ll see how it works out in practice over time.

The Mayor and the City Council have acknowledged that Torontonians have a lot of work to make their city more affordable. The vacant home tax was one of many recommendations made by the Mayor’s Task Force on Affordable Housing in Toronto – which also included recommendations for a speculation tax and land transfer tax.

Get in Touch With a Toronto Realtor

Time will tell what happens with Toronto’s vacancy tax, but so far, it has proven unpopular, especially with the rate of house price increases in the city. Whatever your thoughts on it, if you have questions or want more clarification on anything related to property ownership in Toronto, I recommend getting in touch with an experienced Toronto real estate agent who is familiar with the topic.

If you need clarification on buying or selling a property in the GTA, talk to one of our real estate team members about how our team can help you achieve your real estate goals. We help home buyers and sellers throughout the Greater Toronto area, including Etobicoke, North York, Scarborough, Brampton, Mississauga, Oakville, and more.