Here comes the sun! After a gloomy and grey January, it’s been a pleasure to welcome back the sun to our skies this crisp February morning. The weather is not the only thing heating up, as we see the 2024 Toronto real estate market activity starting to rise. Buyers and investors have jumped back into action and Toronto real estate agents feel things heating up. I’m Britt Huggins, a Toronto real estate agent here to bring you the February Toronto Real Estate Market Update.

Toronto Real Estate Market Update

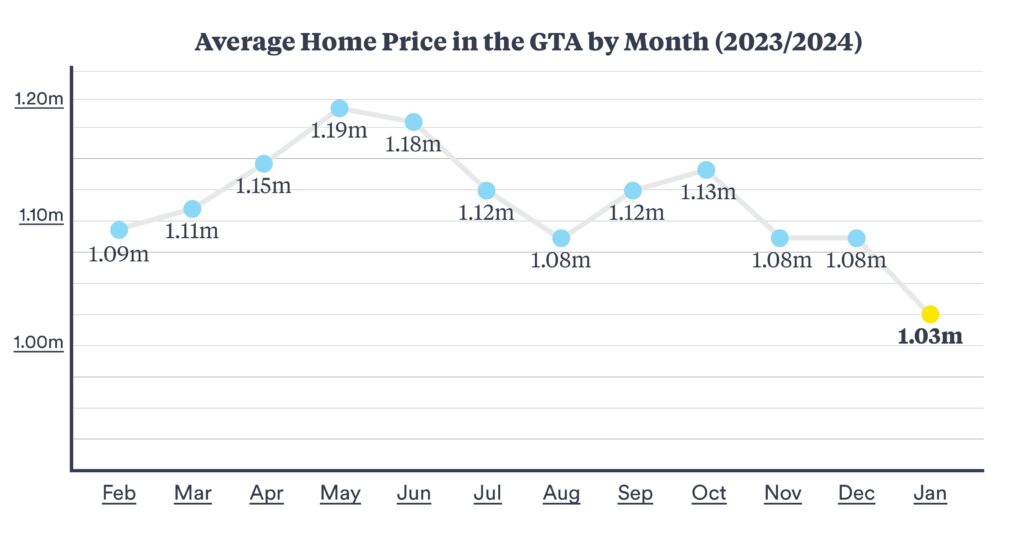

When comparing January 2023 to January 2024, transactions (sales) increased by 37% amounting to 4,223 sales in the GTA. Additionally, we have witnessed growth in active market listings, up to 8.5%. This boost in sales could be reflective of the tighter market, inventory shrinking over the last two months, driving purchasers to jump on properties at a faster pace. That said, we did see the average sales price fall by 1% year-over-year to $1,026,703.

The Toronto Regional Real Estate Board Chief Market Analyst, Jason Mercer, claims that once we finally see the Bank of Canada reducing its policy rate–expectantly in the latter half of the year–housing sales will continue to escalate even more so than the current market. Watch out for competitive buyers as the demand goes up and supply goes down, resulting in a stressful but exciting time for the market!

Overall, the residential real estate industry is of the mind that the available inventory of homes for sale will continue to remain a shallow pool of options, sitting at just below two and a half months at the moment. If we look back to October, we were closer to 4 months of inventory available.

Average Home Price in the GTA By Month

Market Stats by Region

Let’s take a look at some of the regional stats across the GTA, Toronto, Mississauga, Oakville, Durham Region, York Region and Brampton.

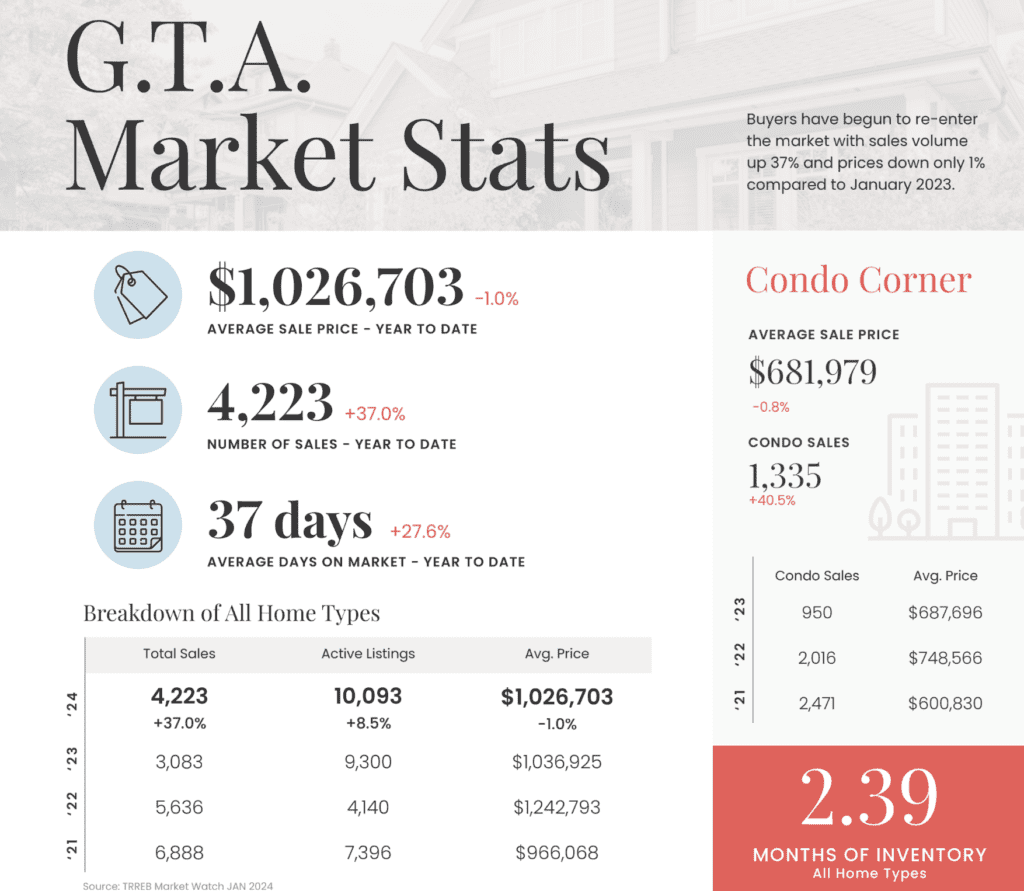

GTA Real Estate Market Stats

In January 2024, the average sale price (all home types) in the Greater Toronto Area was down 1% to $1,026,703 compared to last year. The number of sales however was up 37%. Condos prices in the GTA were slightly down 0.8%, to $681,979. The number of condo sales was up 40% in January with 1,335 condo sales. Inventory is getting tight again. Currently, we have 2.39 months worth of inventory (homes for sale in the GTA). If there were no more homes listed for sale, we would sell out in 2.39 months. As a result of the current market, listings are taking on average 37 days to sell in the GTA.

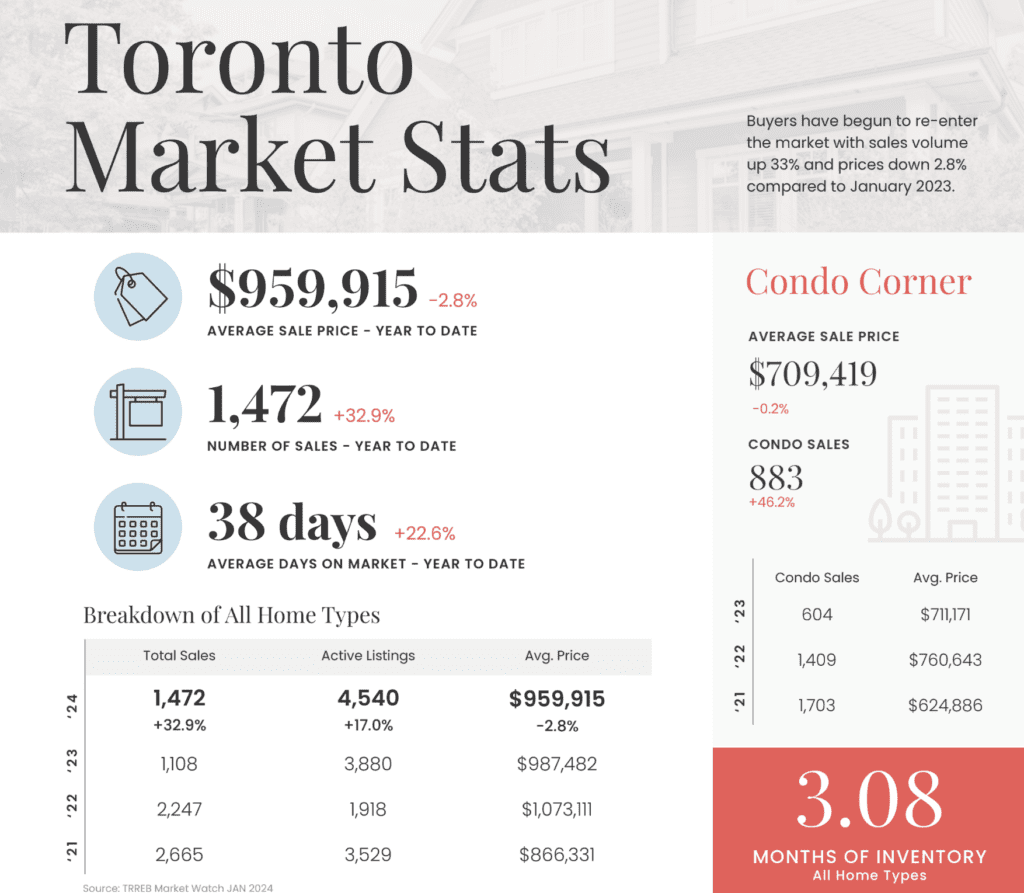

Toronto Real Estate Market Stats

In January 2024, the average sale price (all home types) in Toronto was down 2.8% to $959,915 compared to last year. The number of sales however was up 32.9%. Condos prices in Toronto were slightly down 0.2%, to $709,419. The number of condo sales was up 46% in January with 883 condo sales. Currently, we have 3.08 months worth of inventory (homes for sale in Toronto). If there were no more homes listed for sale, we would sell out in 3.08 months. As a result of the current market, listings are taking on average 38 days to sell in Toronto.

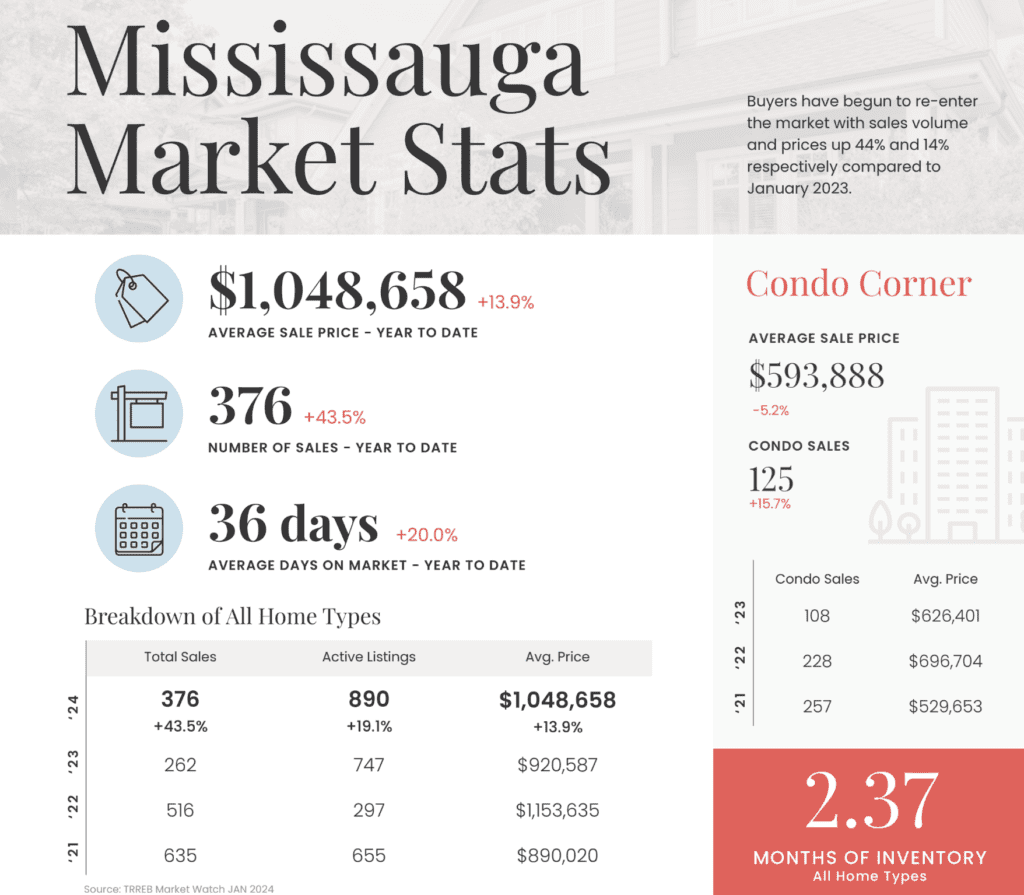

Mississauga Real Estate Market Stats

In January 2024, the average sale price (all home types) in Mississauga was up 13.9% to $1,048,658 compared to last year. The number of sales was up 43.5%. Condos prices in Mississauga were down 5.2%, to $593,888. The number of condo sales was up 15.7% in January with 125 condo sales. Currently, we have 2.37 months worth of inventory (homes for sale in Mississauga). If there were no more homes listed for sale, we would sell out in 2.37 months. As a result of the current market, listings are taking on average 36 days to sell in Mississauga.

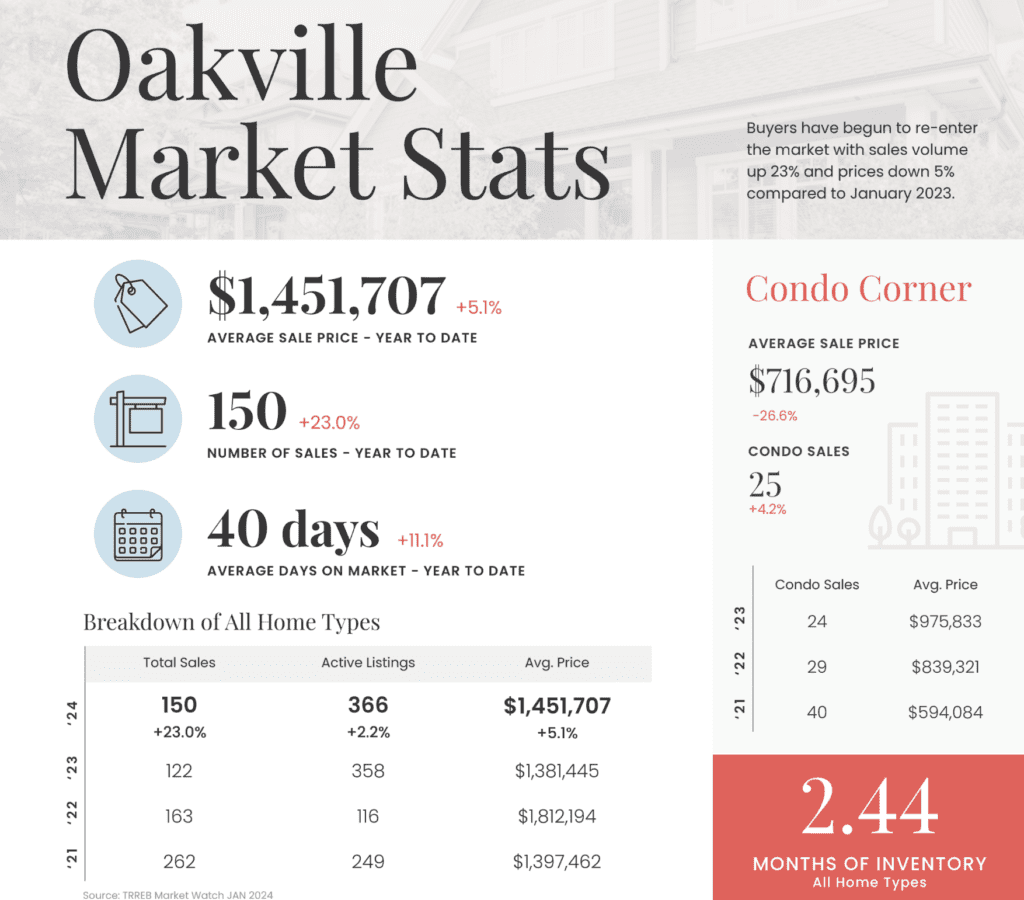

Oakville Real Estate Market Stats

In January 2024, the average sale price (all home types) in Oakville was up 5.1% to $1,451,707 compared to last year. The number of sales was up 23%. Condos prices in Oakville were down 26.6%, to $716,695. The number of condo sales was up 4.2% in January with 25 condo sales. Currently, we have 2.44 months worth of inventory (homes for sale in Oakville). If there were no more homes listed for sale, we would sell out in 2.44 months. As a result of the current market, listings are taking on average 40 days to sell in Oakville.

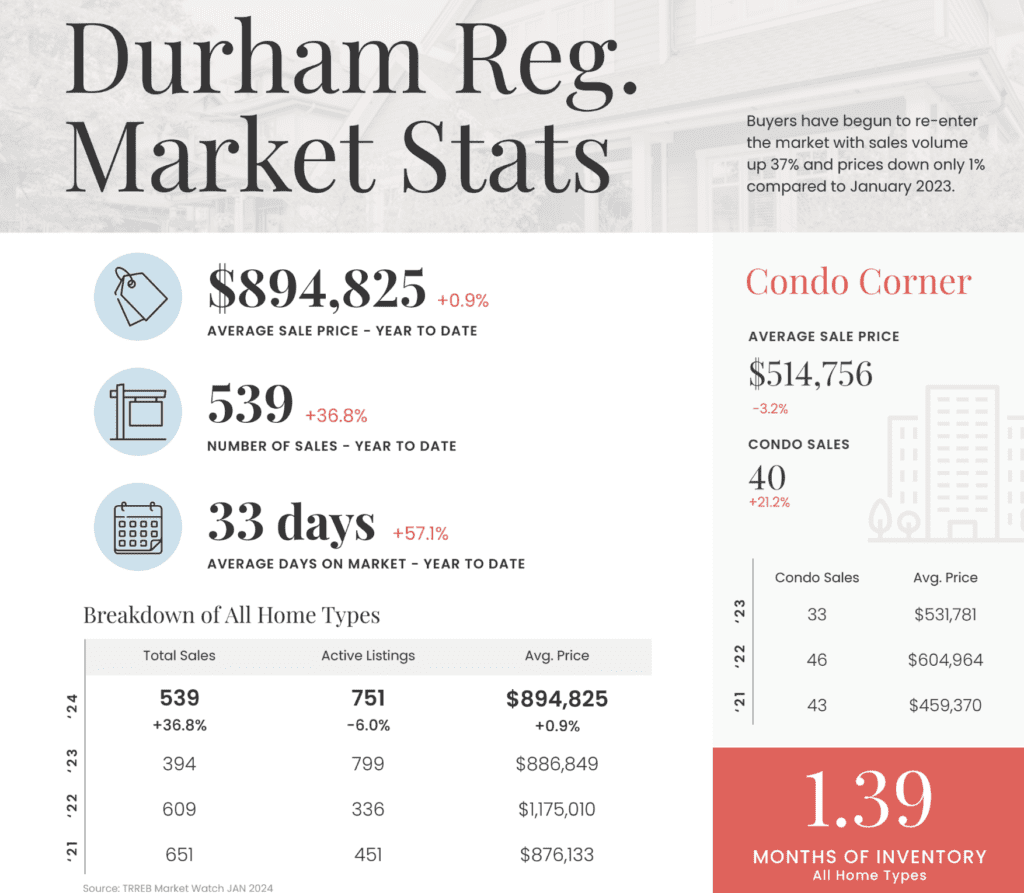

Durham Region Real Estate Market Stats

In January 2024, the average sale price (all home types) in the Durham Region was slightly up 0.9% to $894,825 compared to last year. The number of sales was up 36.8%. Condos prices in the Durham Region were down 3.2%, to $514,756. The number of condo sales was down 3.2% in January with 40 condo sales. Currently, we have 1.39 months worth of inventory (homes for sale in the Durham Region). If there were no more homes listed for sale, we would sell out in 1.39 months. As a result of the current market, listings are taking on average 33 days to sell in the Durham Region.

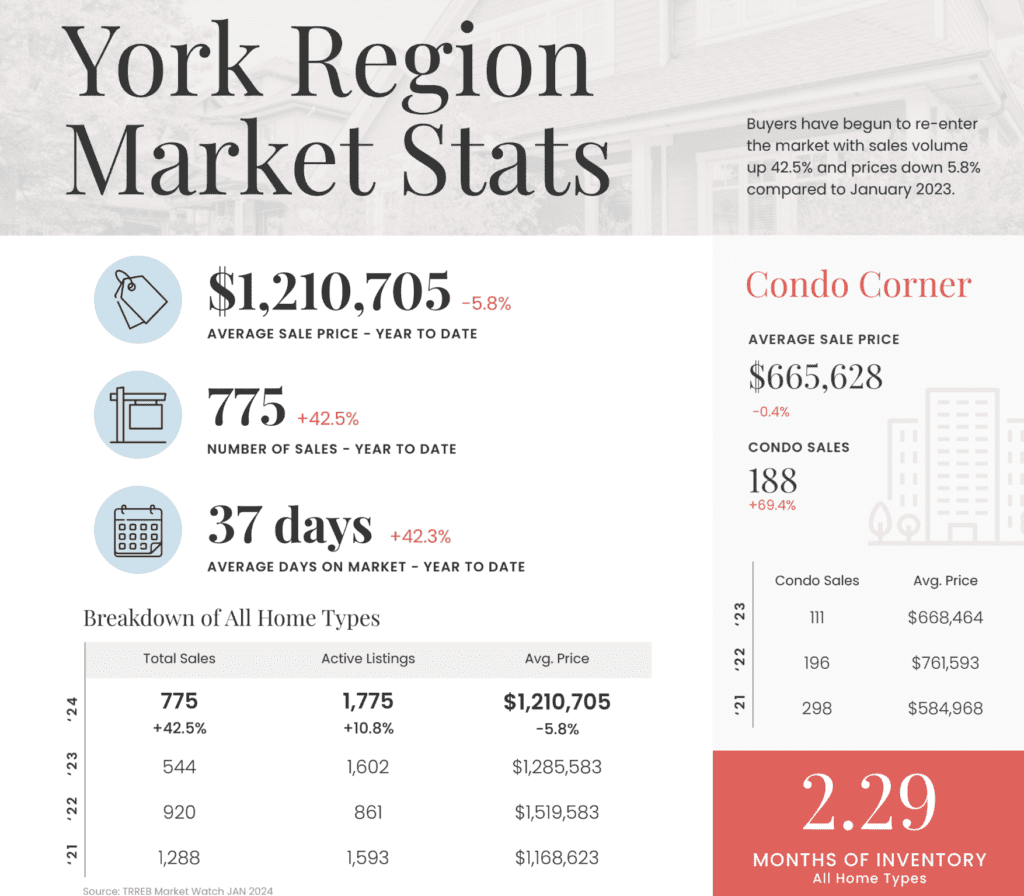

York Region Real Estate Market Stats

In January 2024, the average sale price (all home types) in the York Region was down by 5.8% to $1,210,705 compared to last year. The number of sales was up 42.5%. Condos prices in the York Region were down slightly 0.4%, to $665,628. The number of condo sales was up 69.4% in January with 188 condo sales. Currently, we have 1.39 months worth of inventory (homes for sale in the York Region). If there were no more homes listed for sale, we would sell out in 1.39 months. As a result of the current market, listings are taking on average 37 days to sell in the York Region.

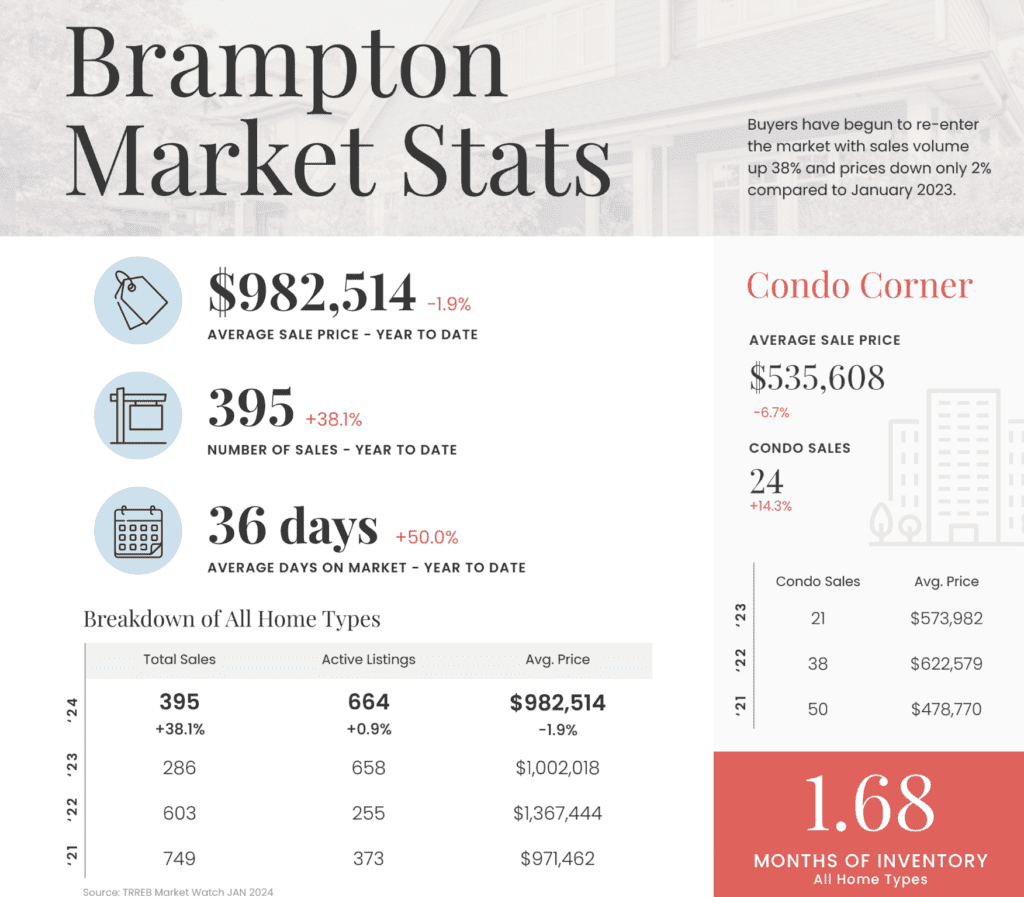

Brampton Real Estate Market Stats

In January 2024, the average sale price (all home types) in Brampton was down 1.9% to $982,514 compared to last year. The number of sales was up 38.1%. Condos prices in Brampton were down 6.7%, to $535,608. The number of condo sales was up 14.3% in January with 24 condo sales. Currently, we have 2.44 months worth of inventory (homes for sale in Brampton). If there were no more homes listed for sale, we would sell out in 2.44 months. As a result of the current market, listings are taking on average 40 days to sell in Brampton.

Another key point is that our province is growing, becoming more populous by the day, and we require an abundance of new housing for our residents. Without options or a surplus of inventory, the price tag on homes for sale, along with the cost of rent will continue to rise at an alarming rate.

A great idea for investors who wish to spread out financial commitments is the world of new development. Developers have increased deposit timelines to expand the 15-20% deposit over a period of four to five years while construction occurs. It’s fair to say that the new homes and condos are not built unless they are pre-sold, which can complicate things for buyers but become great options for others. For more information on this process or any other questions regarding the market, please feel free to reach out to one of our real estate experts!

As professionals in the Toronto real estate domain, we are dedicated to arming our clients with data to make educated decisions on buying and selling. If you are looking to purchase or sell in this dynamic market, please connect with our seasoned team of Toronto real estate agents. Let’s talk!

Source: https://trreb.ca/