Goodbye summer hello fall. It’s time for sweaters and pumpkin spice lattes! As we shift our focus away from cottages and poolside drinks to our careers, school and homes, we are all waiting to see where the real estate market will take us next.

As most of you know, the Bank of Canada just increased interest rates by another .75 points. Banks around the world continue to tighten up their monetary policies as global inflation continues to increase. China is facing more COVID shutdowns as numbers have been increasing since August which will cause a ripple effect globally. Commodity prices are unpredictable: oil, lumber and wheat have settled while the cost of natural gas has increased.

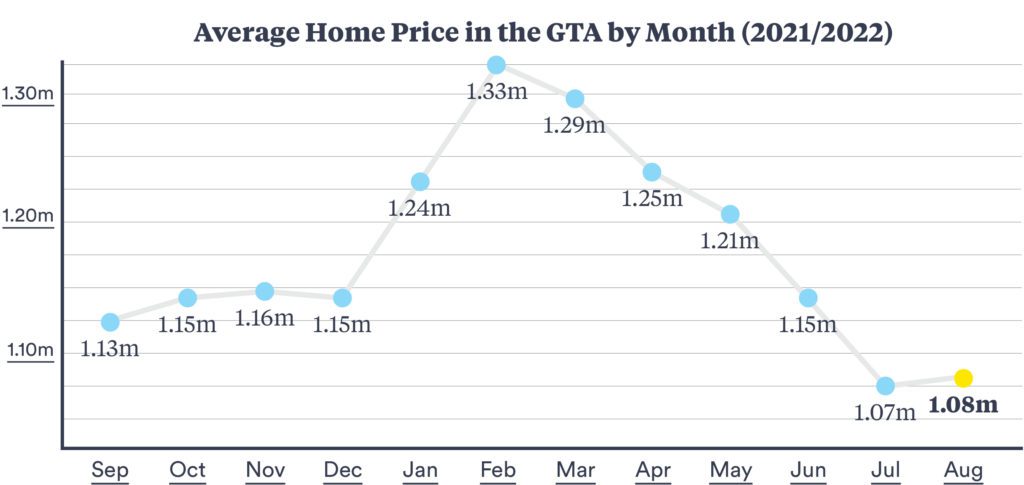

We expect to see the same trends continue next month in the Toronto Real Estate Market (increased inventory and price drops), however, we will confirm that in October once we see the September statistics. For now, let’s dive into the statistics from August 2022 to determine what type of effect July’s big interest hike had on price and transactions.

It is no shock to us that inventory is up. Buyers continue to see more options when on the hunt. The inventory in the Greater Toronto Area is just a little over two months. This means if there were no more homes put up for sale, it would take a little over a month to sell out all of the homes currently for sale. Towards the end of August, when viewing all types of homes, inventory was up by 62% (13,305 listings) when compared to this time last year.

Real estate prices have remained fairly consistent, however, when we look at the markets that appreciated the fastest, we see those markets adjusting the inflation the quickest. Let’s take Brampton as an example: as of August, prices are down 4% than they were in August 2021 and the inventory is up over 130%.

Condo transactions in the GTA are down 40% while prices are up just over 3% to $711,321 when comparing August to this time last year. The condo market will see some action as affordability playing a big role at the moment is. The average price of a detached home in the GTA is $1,379,700 which is almost double that of the average price of a condo.

Let’s drive into the August statistics for the following locations: GTA, Toronto, Mississauga, Oakville, Brampton and Durham Region.

GTA Real Estate Market Stats

When looking at all home types in August 2022, the average sale price in the GTA was up 14.1% to $1,225,582 year to date, when compared to August 2021. When zooming in on condos, prices were up 3.3% to $711,321 year to date, when compared to this time last year.

Toronto Real Estate Market Stats

When looking at all home types in August 2022, the average sale price in Toronto was up 11.8% to $1,165,794 year to date, when compared to August 2021. When zooming in on condos, prices were up 2.2% to $736,940 year to date, when compared to this time last year.

Mississauga Real Estate Market Stats

When looking at all home types in August 2022, the average sale price in Mississauga was up 14.3% to $1,151,428 year to date, when compared to August 2021. When zooming in on condos, prices were up 3.9% to $612,804 year to date, when compared to this time last year.

Oakville Real Estate Market Stats

When looking at all home types in August 2022, the average sale price in Oakville was up 14.1% to $1,670,669 year to date, when compared to August 2021. When zooming in on condos, prices were up 21% to $1,011,520 year to date, when compared to this time last year.

Brampton Real Estate Market Stats

When looking at all home types in August 2022, the average sale price in Brampton was up 20% to $1,215,589 year to date, when compared to August 2021. When zooming in on condos, prices were up 8.3% to $559,274 year to date, when compared to this time last year.

Durham Region Real Estate Market Stats

When looking at all home types in August 2022, the average sale price in the Durham Region was up 17.6% to $1,061,986 year to date, when compared to August 2021. When zooming in on condos, prices were up 10.4% to $552,448 year to date, when compared to this time last year.

These numbers can be confusing, if you would like a further rundown, or have further real estate questions, please feel free to reach out!