This past month has brought with it, a lot of the same pressures that have been part and parcel of living through 2020. Despite most of us feeling like we’ve been living like Bill Murray in Groundhog Day, we have seen some developments in the last month or so. If you’re interested in taking a closer look at those developments, keep reading.

Market prices diverge

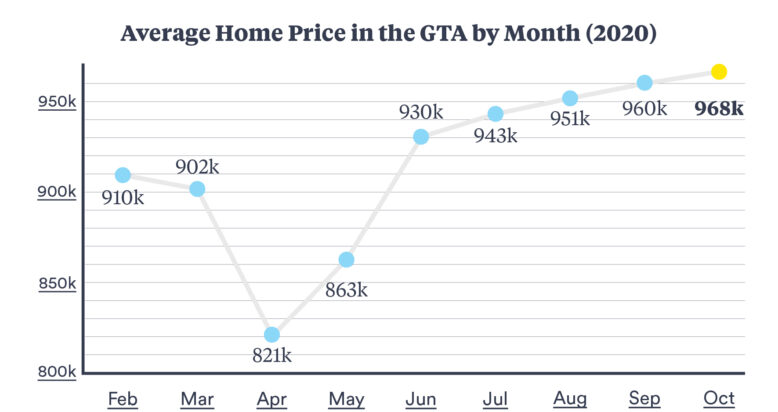

As we’ve mentioned quite often this year, a quick look at the average price of a home in the GTA only scratches the surface of what is going on in the Toronto housing market. This month, the average home price was up 13.7% (year-over-year) to $968K from $852K this time last year– another record high for Toronto and the GTA. Where that growth is coming from is detached homes (up 11.2%) and semi-detached homes (up 4.8%). Condos are flat at .8% growth over this time last year, but even this doesn’t tell us the whole story.

What we haven’t mentioned yet, is that condo sales peaked in February of this year, and the average price this month is actually down 10% from that early 2020 peak. The good news is that the number of sales has remained relatively the same, so demand is still there– and the reason we’re seeing a drop in pricing is a flood of investor driven units and “less desirable” units coming to the market all at once. This extra inventory will eventually be absorbed, but for now, we will probably continue to see prices fall for at least a few more months.

My advice for condo purchasers? Never buy a property you wouldn’t live in yourself.

If my clients follow that advice in this market, they will do well because their properties are a step above the average unit on the market. Many investors say, “it doesn’t matter. It’s just a rental”, but that’s the wrong mentality for buying real estate. If you purchase a unit with care and foresight, you will be just fine.

Canadians are beefing up their savings

With COVID drastically changing the way we all live, Canadians have been squirrelling away all the money that, in other years, would have been earmarked for eating in restaurants, taking vacations and planning weddings– and instead, are using that money to build their savings and pay down debt. We’re calling this “the COVID effect”. A shift in priorities and lifestyle has allowed Canadians’ household debt ratio to fall to the lowest it’s been in a decade and has lead to an evolution of industries.

While sectors like hospitality and tourism have been brought to their knees this year– and the people employed in these industries have been feeling the pinch at home, other sectors have experienced a period of rapid growth, as we’ve all had to pivot to adapt to our new lifestyle.

Everything digital is seeing a massive amount of growth this year, from online learning platforms, to digital marketplaces and everything in between. Unsurprisingly, Shopify is dominating the market this year, as they help small retailers pivot their businesses to accommodate online sales.

Manufacturing in Ontario is experiencing a boom as well. COVID has made us see the virtues of domestic manufacturing, and we are seeing huge investments in development and retooling facilities right in our own backyard. For example, the GM plant in Oshawa, which was slated to close at the end of last year, is currently producing PPE– specifically, N95 masks; and has been promised a $1.6B government investment to retool the facility again for electric vehicle production once the demand for PPE slows once more. Prime Minister Trudeau also announced at the end of August, a $126M investment for the development of a vaccine production facility at the Biotechnology Research Institute branch of the National Research Council in Montreal. A project to be completed over the next few years.

Even real estate has had to adapt quickly to keep up with changes to how we conduct business. While we’re still boots on the ground for showings, other in person services like open houses have stopped completely and we’ve had to rely on online tools more and more in our day to day operations.

Purchasing power is up

We are happy to report that with the rock bottom mortgage interest rates we’re currently enjoying, comes an incredible boost in purchasing power for buyers and an impressive principal repayment to interest ratio. Do you remember when rates dipped below 5% for the first time? At the time, there was a serious frenzy to buy while the rates were low. Since then, we’ve been spoiled with low rates, and while the current sub 2% rates may not last long, there isn’t any indication that we’ll see rates skyrocket anytime soon– especially considering everything that’s going on.

The low rates are at least one good thing that 2020 has given us; and unsurprisingly, these low rates have fuelled continued demand in the market– as we’re seeing in the rapidly increasing cost of freehold homes.

It’s also allowing people to invest in other ways. Some are choosing to carry a larger mortgage rather than putting down the extra cash, so they can invest in other ways. And while the financial institutions have continually predicted we would hit a cliff at the end of the six month mortgage deferral period (which ended on September 30th) with a massive amount of people defaulting on their mortgages, it hasn’t happened yet. Leading us to believe that the market is more robust than the doomsdayers would tell us.

Oh Canada: a safe and stable nation

Good news, my fellow Canadians: Our home and native land continues to enjoy a reputation for being an ideal place to live and an attractive destination for immigrants.

Though the results of the US elections are finally set in stone, and it seems as though Biden and his team will be able to execute a seamless transition into office, the division within the American population has never been more apparent. COVID continues to ravage the nation and political unrest bubbles beneath the surface of their democracy. It seems that even with the ousting of the Trump administration, his base has far from accepted the defeat of their leader, and this could lead to serious political tension and even violence in the coming months.

Despite this uncertainty for our neighbours to the south, Canada is still seen, by the rest of the world, as a safe place to live. Last month, the federal government announced some fairly ambitious immigration goals for the next three years. They hope to bring 401K new permanent residents in 2021, 411K in 2022 and 421K in 2023 to make up for the lull in immigration we’ve seen this year.

Our advice? Get those condos while they’re cheap. Once immigration picks up again we’ll be seeing an influx of new Canadians to the GTA and housing prices will respond to the increased demand.

If you have any questions about this report or you’re considering a real estate investment, reach out to our team. We thrive on providing our clients with the best advice based on the most up to date real estate information.