As the weather gets warmer and people begin to get vaccinated, the city prepares to reopen and we’re starting to get back to our pre-pandemic lives, which means the same goes for the real estate market. We’re beginning to see a healthier market grow and go back to the crazy Toronto condo market we once knew.

The Numbers Don’t Lie… or Do They?

With major news outlets reporting sensationalist headlines like “Toronto area Home Sales Up 362% Since Last April” it’s understandable that most people assume that Toronto’s real estate market is like an out of control train speeding towards destruction. But, as we like to say, “context is key”, and comparing the April 2021 numbers to those of April 2020 just isn’t a fair comparison.

Think back to April of last year. We were only a few weeks into lockdown. The world had pretty much stopped and the only people buying or selling homes were the ones who needed to move. It was truly the bottom for the pandemic housing market. In fact, the market was so slow that this normally very busy real estate team had redirected all of our energy and resources towards more altruistic endeavours– our short-lived charitable organization Health Worker Housing.

That’s not to say that the numbers aren’t up. On average, we would expect to see 10,000 home sales or so during the month of April. This past month that number was 13,663– a ~35% increase over typical years– which is substantial, but certainly nowhere near the 362% that’s being reported.

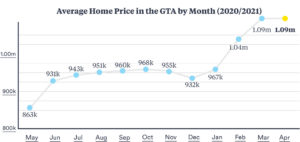

But what about the average price, you say? Yes, the price of a home in the GTA has risen again. In fact, it’s up 33% from last year, and there are a lot of reasons for this:

- Mortgage rates have fallen dramatically low, which has increased buyer purchasing power

- Stay at home orders have meant that household saving are at an all time high, and

- All that extra time spent at home has meant that more of us are hyper-focussed on our living situations and we’re realizing we want more from our houses

With more buyers in the market, and more money to spend on housing, it really shouldn’t come as a surprise that we’re experiencing a price increase.

The good news is that if we compare April’s average price to that of March, we find out that the average price has actually dropped ever so slightly from last month. This suggests that prices are plateauing, and we shouldn’t see anymore skyrocketing values in the very near future.

Our thoughts on all this? It’s easy to grab last year’s seriously depressed numbers and compare them to our currently healthy market to make up click-baity, panic-inducing headlines. But, when we put these numbers into context, it’s pretty clear that all the sensationalism and hype is just that.

The Condo Market’s Back, Baby!

You read that right. Competition has returned to the condo market and pricing is at an all-time high.

If you were unlucky enough to be a condo seller last year, you know this all too well: in 2020 it felt like you couldn’t give away condos in the downtown core.

Last year was a perfect storm for this area of the market. The pandemic closed restaurants, cancelled events and made long commutes a thing of the past. All the perks of city living disappeared seemingly overnight and condo dwellers were left with small units and little to no outdoor space.

It’s no wonder that people were a little less enthused with life in the city.

Around the same time the City of Toronto was changing its rules for short-term rentals and AirBNB business came to a screeching halt.

All of a sudden, investors and end-users alike were trying to offload their units and the market was flooded with condos for sale.

With more units available and fewer interested buyers, prices started to fall. That downward trend continued for 8 months and, ultimately, pricing took a 10% hit. But housing in this city is resilient, and in the last 4 months, we’ve watched condo prices rise from their pandemic low and ultimately surpass the all time high of February 2020.

Clearly, with more and more people getting their vaccines, we’re starting to see a light at the end of this COVID tunnel and confidence is returning to the market. We can only imagine what will happen to pricing once the city has truly opened back up.

Will the Burbs Survive the Reopening?

You don’t have to look far to see where all those condo dwellers were headed. Once they were able to sell their units they set their sights on the suburbs. As a result, pricing in the 905, and beyond, skyrocketed.

The question on everyone’s mind is will the prices remain at the level they’re at now as we return to some sort of normalcy? People will soon be returning to their downtown offices, but will that mean more people will be moving back to the city?

Toronto is less at risk of a price correction on a percentage basis, because the numbers in Toronto are already so high that price changes don’t feel as dramatic or shocking, in comparison to the 905 area.

It feels like we’re heading to a healthier market and Toronto is going back to being a more seller focused market.

Stressful Mortgage Stress Test

As of June 1st the government will be stiffening up the mortgage stress test rate. It’s currently sitting at 4.79%, but will rise to the contracted price plus 2 percentage points or up to 5.25%, or whichever one is higher. Initially these new changes were only going to affect buyers with uninsured mortgages, but as of recently the federal government announced that the same standards will apply to insured mortgages in hopes to prepare buyers for possible increase in interest rates in the future.

These new changes will only have a few small impacts on borrowers and not necessarily in a bad way. There is an expectation that there will be a reduction in buying power by 4% for both insured and uninsured mortgages. This may also lead to fewer bids, which in turn will reduce price pressures.

So with all the new changes it could be for the better. But it really makes us wonder, will this change give the housing market a chance to cool off?

Worried about how these changes may affect you? Let’s connect and discuss your situation.