This month we’re taking a closer look at the changes that are currently affecting the Toronto real estate market, what those changes mean for property owners and prospective buyers, and our predictions for the near future.

Prices Are Up… or are they?

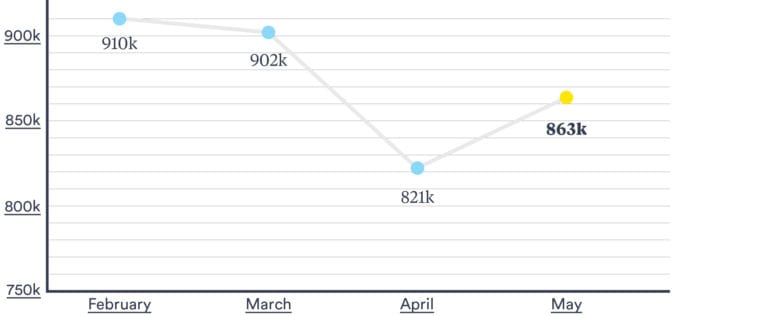

This month the average price for a home in the GTA is $863k*. That’s really great news if we’re comparing it to the average sale price from this time last year, which was $838k. Before you bust out your calculator to do the math yourself, that’s a 3.0% jump in price from May 2019.

However, perspective is everything and stats can be skewed to fit a narrative, so while that seems positive and could give us the impression that COVID-19 hasn’t had any impact on the market, the reality is that that’s not entirely true. When we compare that same average sale price from May to the averages from the beginning of the year, the numbers tell a very different story. Let’s take a look: The average price of a home in February was $910k. We saw a slight drop in March to $902k, and a dramatic drop in April to $821k. But, it’s not all bad news. Remember that number from May? It was 863k. A 5.1% increase from April.

Obviously, we will have to wait to see if the upward trend continues, but last month’s increase indicates to us that we are in a healthy market and that buyer confidence is returning to Toronto.

*Average selling price | All home types | All TREB areas | May 2020

CMHC Rule Changes

CMHC has changed some of their underwriting policies for insured mortgages as a response to the impact that COVID-19 has had on the Canadian economy, the job market and immigration. This is important information for buyers, especially those with less than 20% saved for their down payment. Here are the changes:

- CMHC has lowered their maximum debt service ratios from 39/44 to 35/42

- Borrowed funds are no longer permitted to use for a down payment, and

- The minimum required credit score for an insured mortgage has increased from 600 to 680 for at least one borrower

So what does this mean? It effectively reduces a purchaser’s buying power. For example, if you were approved for a mortgage up to 600k, after July 1st, that number would decrease to approximately 550k. The good news is, minimum down payments are still 5%, and you have options. CMHC isn’t the only game in town; and at this time, Genworth has announced that they will not be following suit– but that could change.

If you have questions or would like more information about insured mortgages– or any mortgages for that matter, we would be happy to connect you with one of our trusted mortgage partners.

AirBNB is Back

Ontario has decided to lift its ban on short term rentals. This is great news for investment property owners whose AirBNB units have been sitting vacant for the last few months. But the lifted ban doesn’t mean business as usual. What remains to be seen is how many tourists will have an appetite for travelling to the 6ix this summer. Many of the city’s AirBNB units have already been sold off or converted to full-time rental units. We suspect it will be a trend that continues. This could be good news for Toronto renters, and the lifted ban means that cottage goers and those looking to escape the city this summer will have some rental options for their Ontario getaways.

Inventory Levels are Down

In May of 2019, there were 20,017 homes on the market in the GTA. In May of this year, that number was only 11,448. Down 42.8% from last year.

But, what does that mean for buyers? With fewer properties to choose from and buyer confidence returning to the Toronto market, we are continuing to see demand outpace supply for quality listings and competition increase for the properties that are out there. This increased competition brings with it price increases and bidding wars.

In the past week, our team and colleagues have been involved in bidding wars on a number of properties across the GTA. In one case, a house in the Annex received 37 offers!

Even with the market challenges presented by COVID, Toronto’s inventory issues will continue to drive prices higher and fuel competition on desirable properties across the city.

If you have any questions about market trends, future outlook, the impact of COVID-19, or anything else real estate related – let’s talk.