Want to know what’s going on in the Toronto housing market right now? Here’s a full market analysis as of July 2020 and a closer look at the outside forces affecting it.

Prices have bounced back

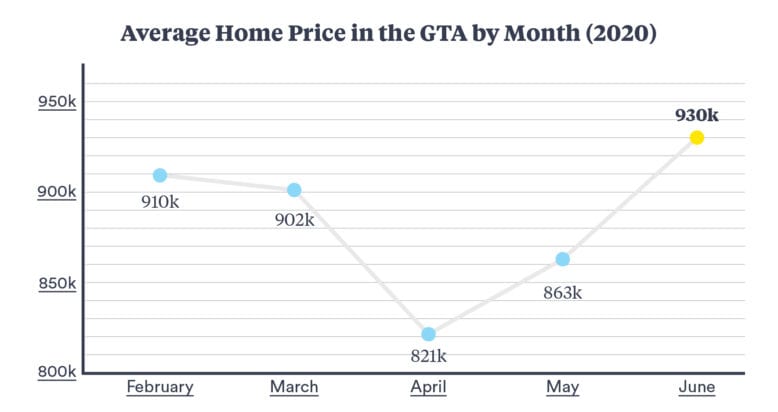

$930,869. That is the average price of a property in the GTA for the month of June 2020. That is also the HIGHEST monthly average price EVER.

Remember April 2017? A period that is often referred to as “the peak”. The moment in time when the Ontario Government stepped in and imposed a foreign buyer tax amongst other measures with the intent of cooling down a red hot market.

Well, here we are 3 years later in the midst of a pandemic and average property prices across the GTA have reached an all time, record high. It’s almost unbelievable– and if you’re a buyer, can understandably be very frustrating / disheartening. But it also speaks to the robustness of the Toronto market and the sheer demand for housing.

Three years ago we were quick to blame foreign buyers for the ramp up in prices but this time around it’s clear that the demand is local and not investor driven. People want to live here.

The difference between then and now is there is definitely more caution being exercised. Yes, multiple offers are becoming commonplace again, but not EVERYTHING sells in multiple offers and there is more rhyme and reason to pricing– for the most part.

All this said, what we’re seeing in the age of COVID-19 is that market conditions and buyer/seller confidence can change on a dime, so let’s not take anything for granted and understand that there are still reasons to be cautious– especially if you’re thinking about buying a condo. More on that below.

Canada’s COVID handling gets international applause

Canadians may not all agree with all the closures and emergency orders that our government has implemented to keep our COVID infection rates down, but a quick look at the numbers tells us that we’re doing something right; and the world agrees. Canada has received international praise of our containment of the virus from Time Magazine and CNN, among other publications.

But, what does this have to do with Toronto’s housing market you ask? Great question. Immigration may be halted for the time being, but this type of coverage only makes Canada’s standing as a choice destination that much stronger; And Toronto has long been one of the cities of choice for new Canadians to call home. Once those borders open back up you can be sure that Canada– and Toronto by extension, will see an influx of immigration that will continue to drive demand for Toronto real estate.

Another positive change for the Toronto housing market as a direct result of the pandemic is the low, low mortgage rates we’re currently seeing. With higher levels of unemployment, banks are battling for business and offering deep discounts as a result, and our clients have been offered some pretty incredible rates. In one instance, a client was able to secure a five year fixed mortgage for under 2.09%.

If you’re interested in taking advantage of these super low rates, please discuss your specific situation with a trusted mortgage professional before jumping in feet first. Need a recommendation? We can connect you with one of our trusted advisors.

Trouble in condo paradise?

If there’s one vulnerable segment of the market, it’s condos. Buckle up, because there’s a lot to unpack here. TLDR: short term uncertainties, long term optimism. Want specifics? Keep reading.

COVID has brought with it some dramatic changes to buyer ideals. Only a few months ago, shorter commutes and proximity to city hotspots were king– but with no where to go, and more time spent at home, Torontonians have a newfound appreciation for space– both indoor and outdoor.

Commute

The ability to work from home has meant that for a lot of city dwellers, their need for a short commute has disappeared entirely and with companies like Shopify leading the charge on a “digital by default” policy going forward, it’s likely that working from home will be the new normal for many office workers long past our economic reopening. This change to working life has meant that, for many condo owners, proximity to the city centre isn’t as necessary as it once was.

Restaurants + Nightlife

Combine a non-existent commute with the closures of restaurants, nightlife and entertainment, and you’ve got a huge group of buyers who no longer feel the need to sacrifice space for convenience. Without bars, restaurants, shows and sports to flock to, there’s less incentive to be “in the middle of it all”.

Once we have a handle on COVID and more businesses start to open back up permanently, I’m certain that we will see people returning to the city centre, but in the short term, this is having a huge effect on the market.

AirBNB

As if that wasn’t enough, the pandemic has brought with it a dramatic drop in AirBNB business. Sure, we somewhat expected some of these challenges when the City of Toronto and other municipalities started to discuss restrictions or even all out bans on AirBNB units, but no one could have predicted the COVID factor.

Many condo owners operating AirBNBs pre-COVID have switched to full time rentals. This has lead to a spike in inventory on the rental side. No longer a landlords market — for the first time in years, rent prices have decreased and tenants have options.

I believe we’re in for a bumpy ride in the condo market for the next year or so. We haven’t seen the full impact of all the above factors yet, and it’s very possible that we will experience what I have dubbed the “Great Condo Sell Off” in the next few months. Sadly, I also predict that most of these will be subpar units previously purchased as investments.

Anyone who has gone condo shopping recently understands what I’m talking about… It may seem like there are hundreds of places out there, but to find one that has a functional layout, decent view, and nice finishes seems to be rare. The best properties will continue to garner attention and perform well comparatively in the market, so if you’re buying as a primary residence or a long term investment, you’ll be fine.

CMHC needs to check their crystal ball

Last month CMHC made a broad– and what many people considered, unsubstantiated– prediction that property prices could fall by as much as 9 to 18% as a direct result of the virus. Here’s what they’re predicting will happen in Canada’s major urban centres:

- Sales and construction have dropped

- House prices will likely fall because of uncertainty over the economy’s path

- It is possible that vacancy rates increase in the rental market

- Recovery in major markets is highly uncertain and will vary considerably

This all seems pretty scary for Toronto home owners, but this isn’t the first time that a financial institution has made predictions about the housing market that fall somewhat short of reality.

In 2015, TD made this claim:

“Broadly, home prices are currently growing at more than twice the pace of income gains, and housing affordability is eroding, particularly in Toronto and Vancouver. Given lofty prices, Toronto and Vancouver are likely the most vulnerable should a rise in bond yields in 2016 and beyond get passed along to mortgage rates. However, with the economic backdrop remaining comparatively favourable in Ontario and B.C., a severe correction in housing activity will likely be avoided. Following an estimated expansion of roughly 8-10% in 2015, average home price growth in Ontario and B.C. is poised to slow to just 3-5% next year. At this rate, the degree of price overvaluation – which we estimate at around 10-15% – is likely to remain, leaving these markets vulnerable to the adverse impact of an unanticipated shock to either interest rates or the unemployment rate.” TD 2015

But, in fact, average home price growth didn’t slow at all, and in August 2016 the average price of a home in Toronto was up 17.7% from the previous year* (TREB Market watch August 2016)

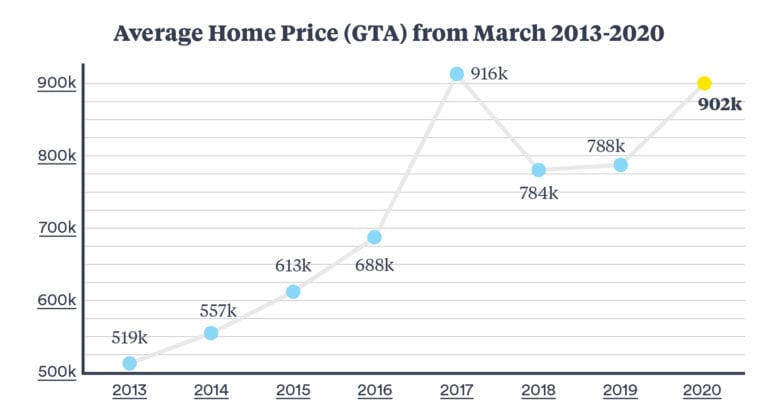

In February 2014, both IMF and TD concluded that Canadian home prices were overvalued by 10%. Certainly scary for anyone purchasing a home at the time, but that 553k average price is looking awfully good to anyone trying to get into today’s housing market.

In March of 2013 TD shared this prediction:

“[The] past decade has been fairly positive for housing – home prices have grown by roughly 7% each year at the national level. In stark contrast, the Canadian housing market has undoubtedly cooled down over the past six months. Tighter mortgage rules and stricter lending guidelines are two of the catalysts contributing to the sales correction and slowdown in price growth. Even with the cool down, prices are still out of sync with underlying economic fundamentals like price-to-income, price-to-rent, and monthly affordability metrics. These trends, combined with higher interest rates and modest economic growth, should mean a gradual, downward housing market adjustment over the next few years. Beyond 2015, we project price growth to rebound to their long-run cruising speed of 3.5% based on our view of the underlying fundamentals. In light of the profile, the next decade as a whole will see measly 2.0% annual price gains.”

For context, the average price of a home in the GTA in March 2013 was $519,879. In March of this year, that number was $902,680. That’s a 73.6% growth over the last 7 years, which is a far cry from the “measly 2% growth” they were predicting over the decade.

Our thoughts on CMHC’s predictions? Financial institutions should probably stop making predictions. Sales and construction have seen a slight slow down as a direct result of the pandemic and economic closures, and the rental market is currently a happier place for renters. But, with prices and demand at an all time high, and multiple offer situations returning to the city, I have a hard time believing that prices are going to go into a freefall any time soon.

Congratulations CMHC. I guess 2 out of 4 isn’t bad.