The Freehold Frenzy

The Freehold Frenzy has gripped Southern Ontario– from Hamilton to Bowmanville and everywhere in between, prices are way up and competition is fierce.

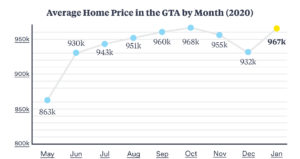

We’re seeing a lot of parallels between the market this past month and the market in 2017. Multiple offers are the norm, homes are going way over their listed price and inventory is LOW, but unlike 2017, the 416 isn’t the only area affected; we’re seeing it all over the GTA.

AND, there’s virtually no immigration right now.

Foreign buyers were the scapegoat in 2017, and the general belief was that increasing the foreign buyer tax would dissuade off-shore investors from parking their money in Canada, lessen the competition in the market, and ultimately solve the affordability crisis. But, if that was the case, then where is all this demand coming from now?

We’ve all been stuck at home for the past year, ordering takeout and working from our kitchen tables. It’s got us yearning for more space and caring a whole lot less about commute times. Couple this new(ish) reality with the lack of quality inventory that we’ve been talking about for the last decade, and you’ve got the ingredients for the extreme sellers market we’re seeing now.

The resurgence of the condo market is only adding fuel to this fire. Everyone who had hoped to offload their downtown units last year is finally able to do so, and now that they’ve got that money freed up they’re ready to make a move.

Fast Fact: The number of sales for freehold properties in the GTA is up 42% over this time last year.

Condo Bounceback

For the better half of 2020, the condo market was stagnant, with properties sitting for months and buyers nowhere to be found. Around the end of November and into December, we started to see signs of life and activity begin to pick back up.

What’s interesting is that rents are way down and vacancy is way up. With the service industry still hurting, airbnb units sitting empty and students still missing from the city, investors can’t count on a guaranteed tenant– nor can they expect to be cash flow positive for the foreseeable future.

So, who’s buying these condos? Either we’re seeing investors with seriously deep pockets buying up units, or more likely, there are a whole lot of end users finally able to break into a previously unaffordable market.

Now that we’re a month into 2021, inventory has begun to shrink from the 4 months we saw last year, back to about a month and a half. This is putting a ton of pressure on pricing to go up. Prices haven’t started to move much yet, but from what we’re seeing on the ground, it’s only a matter of time before they shoot up again.

Fast Fact: Months of inventory in the condo market has shrunk from 4 to 1.5 in the last few months, swinging the pendulum back in favour of sellers. Anything under 3 months is considered a sellers’ market.

Low, Low, Low, Low Mortgage Rates

With rates this low you can afford boots with the fur.

Just when we thought mortgage rates couldn’t go any lower, they did it again. Most lenders are now well below 2% for 5 year fixed rates and we’re even seeing options below 1.5%. These lower rates are making the decision to purchase and carry a higher mortgage much less daunting, and although prices have increased, the drop in rates has offset this jump and more of your dollar is going to principal repayment rather than interest.

But what happens when rates go back up? I guess we’ll see what happens in five years when these mortgages are up for renewal. But, we’re quite certain that the government will have a vested interest in keeping rates low for the foreseeable future– and given how robust the Toronto real estate market proved to be throughout a global pandemic, I wouldn’t bet against it anytime soon.

It’s also worth mentioning that stress tests are still in place. Though people are being offered rock bottom loans, they’re still being qualified at a higher rate, so that if things do change and rates go back up, we shouldn’t see a massive amount of foreclosures.

We’ve got a Log Jam

This isn’t a new issue, but right now it’s seeming A LOT more pressing.

To say that there are a lot of folks who are interested in making a move would not be a groundbreaking statement. Families are looking for more space, elderly people need to downsize, but the lack of quality inventory has people in a freeze pattern.

It would be very easy to sell right now. However, the question we’re always asked by our clients is, “if we sell, where do we go?”

A few months of this type of situation in a market can be balanced out, but the fact that it’s been going on for years makes it a much more difficult issue to resolve. We’ve talked about this over at the Globe and Mail in the past and it’s really one of the biggest problems we face in the market.

A lot of seniors in this city are in homes that are far too big for them, but the concern of not finding somewhere suitable to live has everyone in a holding pattern. Getting roped into multiple offer situations, and the very real possibility of not being able to qualify for a mortgage post-retirement means that there are a lot of people trapped in a space that no longer suits their needs.