There’s no denying that so far, 2020 has been a year unlike any other. From a once in a lifetime pandemic, to natural disasters, and political uncertainty south of our border, it feels like we’ve spent the last 7 months on a roller coaster. The Toronto real estate market has been no exception. For realtors and home owners alike, this year has had more ups and downs, and plot twists than an M. Night Shyamalan movie. Here’s a detailed look at what July had in store for all of us.

Is Toronto experiencing a mass exodus?

In the past month, we’ve had clients looking to buy in Whitby, Kitchener-Waterloo, Prince Edward County, and even as far as Kingston. Sorry for the click bait-y title. We definitely don’t want to sound alarm bells, but there is no denying that buyer ideals are changing and yes, even leading some out of the city to greener pastures– or just bigger yards.

If you’ve been around here for a bit, you know we touched on this last month. COVID precautions have shuttered businesses, cancelled ball games and made dining out a thing of the past (though we’re already starting to see the return of some of these). With nowhere to go and no traffic to contend with, Torontonians living in the core quickly started seeing the upside to life outside the city.

Do we actually think we’re experiencing a mass exodus that will cripple the real estate market indefinitely? Absolutely not. Yes, buyer ideals are changing; yes, we are seeing some people choosing to leave; and yes, the condo market is currently experiencing a correction (more on that below). But rather than the market crash that has been predicted time and time again, all these changes have, in fact, driven competition higher for freehold homes in the 416. June and July saw wild jumps to the average price of a home in the city and we’ve personally been witness to numerous multiple offer situations. It’s normal to see a lull in the market for the summer months while people are vacationing, and not really thinking about buying homes, but this summer has felt more akin to spring 2017.

Bailout season is over.

Though many Canadians have returned to work, there isn’t an end in sight to the economic lull for many industries. And with CERB ending at the beginning of October, mortgage deferral periods starting to end around the same time, and many people still out of work, we are very curious to see how the government will respond.

Certainly, a great number of those on CERB will be moved over to EI, which means there will be more hoops for people to jump through to get their money. This could mean a spike in inventory for Toronto real estate, but don’t get too excited. Any surplus in supply will be very temporary.

Demand for houses is high and any well-priced freehold homes will be snapped up in a matter of weeks. Where we will probably see more opportunity to buy is the condo market. We’re already starting to see some units taking longer to sell and selling for less than they would have a few months ago. It’s likely that it will take a little longer for the extra condo inventory to disappear. So, if you were thinking about getting into the market, it’s time to get your ducks in a row. The next six months could provide some great opportunities for buyers to snatch up units at prices they could only dream about a few months ago.

While there will be opportunities, don’t expect a crash in prime building. Unique units will continue to hold their value and as we said last month, if you’re looking for somewhere to live or you’re planning a long term investment, you’ve got nothing to worry about.

Low interest rates will be around for a while.

In an unusually candid press release, the Bank of Canada announced that it’s overnight lending rate will hold steady at 0.25% until 2023. This is great news for anyone needing to refinance in the next couple years or anyone looking to enter the market. While the overnight lending rate doesn’t directly affect how much interest you’ll pay on your mortgage, it does influence the prime rate, which will certainly have an impact.

Remember all those great deals we talked about above? Get ‘em while they’re hot. Low mortgage rates mean that more people are able to buy, which helps to drive competition within the market. Once those deals are gone, they’re gone. We’re confident that any market corrections that we see this year won’t last forever. How do we know? Keep reading.

Toronto has an inventory problem.

Real estate experts in the city sound like a broken record. If I had a dollar for everytime I heard the phrase “lack of inventory” in reference to the Toronto real estate market, I might have enough money to live on the Bridle Path. And, if the pandemic has done anything, it’s made it abundantly clear that that lack of inventory isn’t entirely driven by immigration or foreign investors. It’s regular, everyday local people looking to put down roots and build equity.

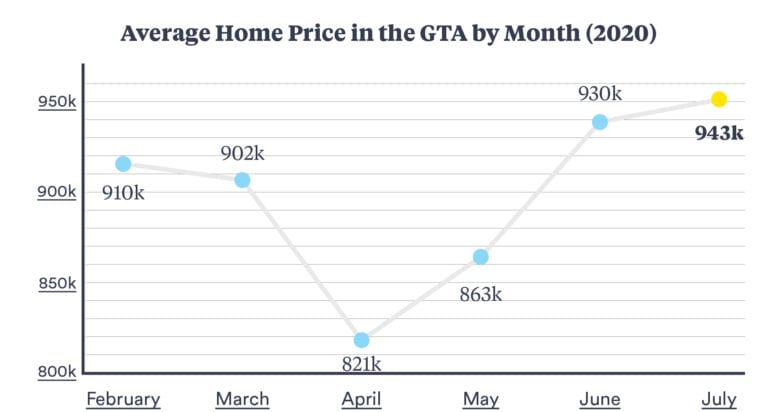

July saw a new all-time high for its average home price across the GTA– rising to $943k. The average growth in Toronto by area was 9% (year over year), with more affordable areas in the east and west ends of the city seeing a greater bump in price. These are the neighbourhoods people are flocking to because there is value to be had. Homes in these lower price areas are being snapped up by local buyers getting significant support from family.

Once immigration returns it will increase demand for housing. New construction only has enough capacity to produce 20,000 units every year, and with 150,000 new Torontonians coming to the city annually, there’s no where for prices to go but up.

We may find that the return of immigration will help to boost the sluggish condo market if it hasn’t yet recovered on its own.

The takeaway? Even in times of uncertainty, Toronto real estate continues to be a relatively safe investment.

Context is key.

The numbers look great on paper, and we would love to be able to tell you that the market activity we’re currently experiencing is here to stay, but we really need to put everything into context.

The COVID shutdowns brought the real estate market to a crawl this spring when we would have normally seen much higher activity. We believe that what we’re seeing now is a delayed spring. We’ve seen it before. After the financial crisis ended, the summer of 2009 brought with it all sorts of pent up demand and we saw no seasonal fluctuations in the market that year. In fact, we continued to see uninterrupted market growth until 2017!

Maybe 2020 will follow the 2009 trends and we’ll see no seasonal fluctuations, or maybe, we’ll have a “delayed summer” and this fall will be abnormally quiet. We’re not totally sold on that prediction though. With people spending more and more time at home it’s clear that they want to invest in their homes. Everyone and their mother has been building decks and landscaping their yards. From what we’ve heard, you couldn’t have a pool installed right now even if you wanted to pay a premium for it; And Wayfair stock has soared this year. From $39 in mid March to an astounding $312 as of August 4th.

One thing is certain: people want to make improvements to their homes, they want to move up and they want more space.