New year, new Luxury Land Transfer Tax. Yes, you read that correctly. As of January 1st, 2024, the city of Toronto introduced a new Luxury Tax. Being a Toronto real estate agent, we know the importance of keeping our clients armed with the most up-to-date information regarding the Toronto real estate market, so let’s get to it! What does this new tax mean for potential buyers who plan on purchasing a luxury home in Toronto for over 3 million dollars this year?

Toronto is no stranger to adding a Municipal Land Transfer Tax (MLTT) on top of the separate provincial Land Transfer Tax required for every real estate purchase. However, in September 2023, Toronto’s city council decided to introduce an increased “Luxury Land Transfer Tax” that would go into effect on January 1, 2024. Any residential Toronto real estate purchased at $3 million or more will be impacted by this increased tax.

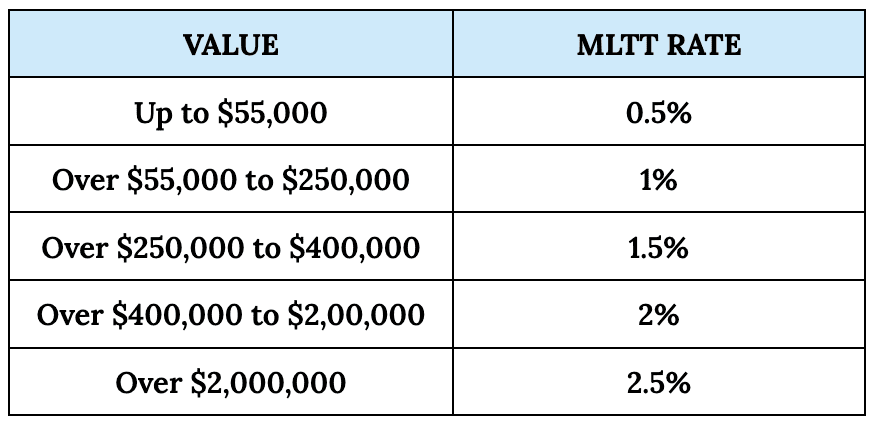

Buyers will still owe the Ontario land transfer tax of 2.5% on top of the new municipal tax. If you made a purchase in 2023 but it doesn’t close until after January 1, 2024, the new MLTT rates are now applicable to your transaction. Let’s take a look at the differences between the former and new rates below:

FORMER TORONTO MUNICIPAL LAND TRANSFER TAX RATES

NEW TORONTO MUNICIPAL LAND TRANSFER TAX RATES

Using the tables above, let’s dive into an example of buying an 11-million-dollar home in Toronto in 2024. The one-time, up-front, Municipal Land Transfer Tax that you would owe to the City using the new rates would be $715,000. Additionally, you would owe $275,000 (2.5%) for the provincial land transfer tax which brings the total to $990,000 in Land Transfer Taxes. With the old rates, a purchase like this would result in owing $550,000. That’s a big difference!

The Potential Effect on Sales

The introduction of the new tax rates during a time when the real estate market is already downtrodden due to high mortgage rates doesn’t seem like very fair timing. Will the new tax hinder sales? Will those in the luxury market just soldier on despite the tax? Only time will tell.

Some Toronto real estate agents have taken note that their high-end clients have continued to push through with their transactions regardless of the new tax parameters. While these buyers might not love the tax hikes, they typically still have the financials to pay. What will happen to the market when those who are turned off by the tax look for homes that are under the 3 million dollar mark? These types of buyers may impact the market by decreasing the inventory in the under $3 million range, which is already short in supply.

The Potential Effect on Other Markets

Placing a municipal land transfer tax in addition to the provincial land transfer tax is a practice that is uniquely Torontonian. We can’t help but wonder if the increased MLTT will dishearten luxury market buyers from purchasing in Toronto. Perhaps they will be fed up with the new tax and choose to make their purchases outside of the city. If so, this could potentially be beneficial to markets outside of Toronto that have affluent neighbourhoods such as those in Mississauga or Oakville.

More than likely, the tax will have little impact on luxury clientele. For those who can afford to buy a $15 million home, the additional tax will be of little to no issue. Having a piece of high-end Toronto real estate will likely be more important than the extra tax.

If you have any questions about the new “Luxury Land Transfer Tax” or are ready to buy your dream home for over $3 million despite the new tax, never hesitate to contact our expert Toronto real estate team. We are here for all of your real estate needs!