Yes, you read that title correctly. The Bank of Canada has done it again. I’m Britt Huggins, Toronto Real Estate Agent and I am here to give you a quick update on the latest interest rate increase, along with previous hikes and where we stand today.

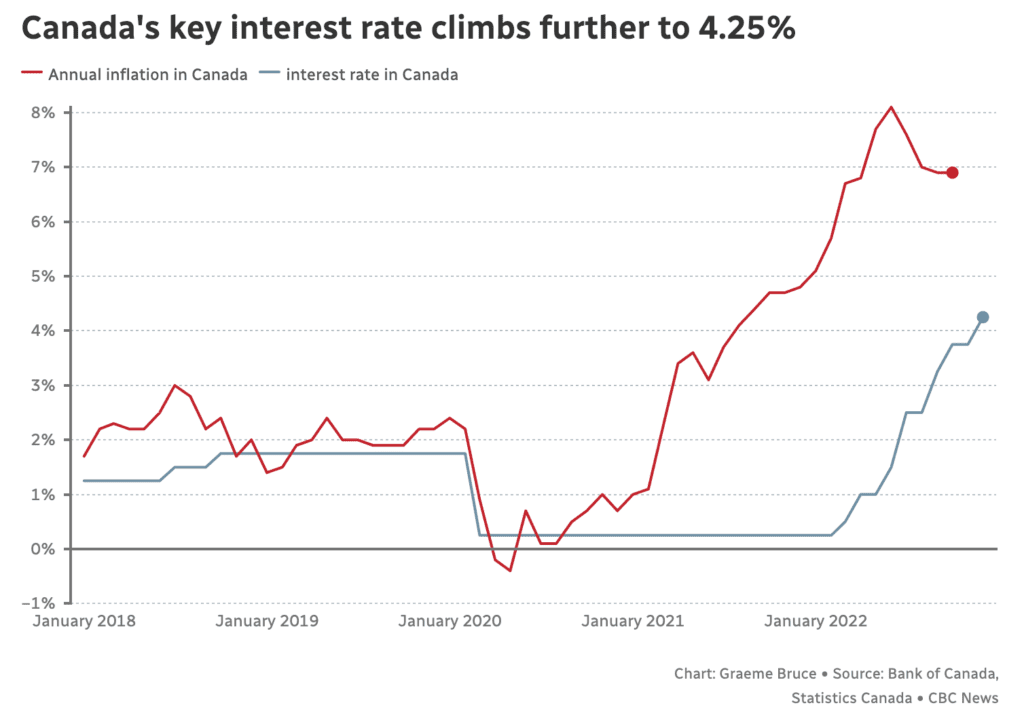

The central bank has been battling inflation, raising rates 7 times since March, 2022. This has been the most aggressive rate hike on record. Today, the Bank of Canada raised its benchmark interest rate by 50 points to 4.25%. Economists had anticipated the increase of 25-50 points to assist in the fight against inflation. We have witnessed the bank increase rates from 0.25% to 4.25% since March.

Previously, the Bank of Canada clearly communicated rates would continue to rise until inflation came back within the range of up to 3% that it targets. The tone today has slightly shifted to a more “wait-and-see” approach. The bank said:

Looking ahead, Governing Council will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target.

This has significantly impacted the rates that Canadian businesses and consumers are getting from their banks on mortgages, savings, etc. It’s a tough time for many people out there, especially around the holiday season. We encourage anyone that is able to lend a helping hand to their community to do so through donating food, money, volunteering, etc. We will be participating in a food drive, click here for more information.

As always, we are here if you have any questions regarding the Toronto real estate market. If you would like to get some further information on mortgages, please feel free to reach out to our mortgage expert Arlene Karram.